The rise in ESG investment contributes to increasing demand for quality and comprehensive non-financial information disclosures.

Leaders have stepped up to simplify voluntary ESG standards with three major proposals which are anticipated to dominate the ESG reporting landscape in 2023:

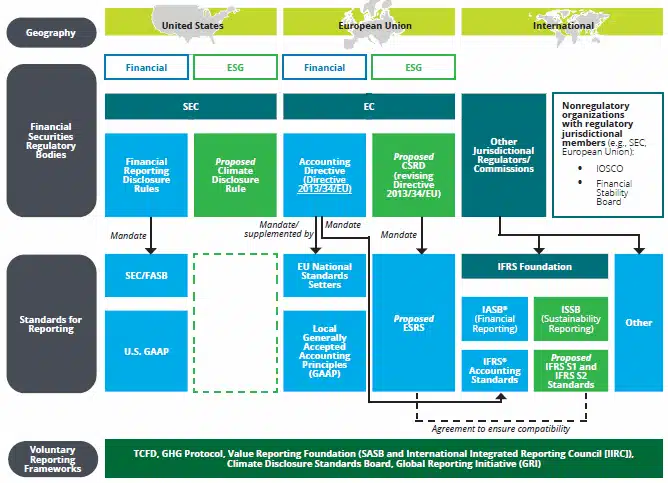

- The International Sustainability Standards Board (ISSB),

- the European Union’s Corporate Sustainability Reporting Directive (“CSRD”) and the

- and the United States Securities and Exchange Commission (SEC) proposed rules.

However, much work still needs to be done.

- The imbalance force of impact materiality and financial materiality. More than two third of the existing standards and guidelines focus on financial-related materiality matters. But is it worth putting a “penny” on everything?

- The neglected child – SMEs. Many guidelines are based on and focus on big companies without realizing the crucial part SMEs play in global sustainability. Many enormous and complex sustainability frameworks suck companies’ resources which SMEs can barely afford. SMEs’ voices need to be heard more.

TREND 2: Transitioning to Net-zero

Countries and companies have taken responsibility for climate change and raised their carbon emissions reduction ambition. As a result, 91% of the global economy and 810 out of the 2,000 largest companies have pledged to net zero. However, not many of them are supported by scientific figures, nor do they seem to be feasible to be achieved. According to one Research conducted by Accenture, only 7% out of over 2,000 companies will reach their net-zero commitments.

Moreover, many of the net-zero pledges heavily rely on carbon offset schemes which are argued that does not make a lot of sense in the long term.

“There’s a heightened awareness that perhaps this is not such a legitimate way for companies to prove they’re sustainable and meet their net-zero [targets]. I’m seeing more accusations of greenwashing when companies are just using carbon offsets.”

Nicola Stopps, CEO of consultancy Simply Sustainable

Companies do not only need a more credible Net-zero roadmap but also better to put extra effort into reducing carbon emissions instead of falling into offset schemes.

TREND 3: Transparency and “Greenhushing”

After the rise of the 2021 Green Claim Code by the UK’s watchdog, awareness of greenwashing is growing and has become one of the “words of the year” for 2022.

Added to the picture was the question of the transparency of the ESG rating agencies. The blooming market of one player plays two sides of rating and consulting, raising concerns about the credibility of green claims, especially the ones based on the rating scores.

“The public and stakeholders are definitely becoming more educated and aware and savvy… companies need to take this a lot more seriously.”

Nicola Stopps, CEO of consultancy Simply Sustainable

Interestingly ‘greenhushing’ was predicted to be a trend in 2023. This is when brands fear accusations of insincerity so much that they avoid talking about sustainability at all, even when they’re taking steps to improve.

This is obviously not a great development as well. What the market needs are a transparent and trustworthy claim, not an exaggeration and false claim or all quiet.